W2 payroll calculator

See a breakdown of your payroll expenses by employee expense type and more. Among the services Central Payroll provides are assistance with salary verifications for housing and mortgage application payroll garnishments support I-9 processing and assistance and W-2 reprints.

Calculation Of Federal Employment Taxes Payroll Services

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

. NannyPay nanny tax software will save you thousands of dollars over popular nanny tax. If you have questions regarding information within the W2 Tax Form or the 1095c Tax form please visit the Payroll Tax Forms Direct Deposit page. Skipped Health Deductions Schedule.

The majority of businesses and also the military services now provide free w2 online retrieval. Employees get online access to pay stubs and tax forms and can update their banking and contact details. Run payroll for hourly salaried and tipped employees.

As many already know 1099 contractors must pay both the employee and employer portion of the payroll taxes. 202223 Tax Refund Calculator. More than just a tax calculator NannyPay will maintain all your nanny tax payroll records.

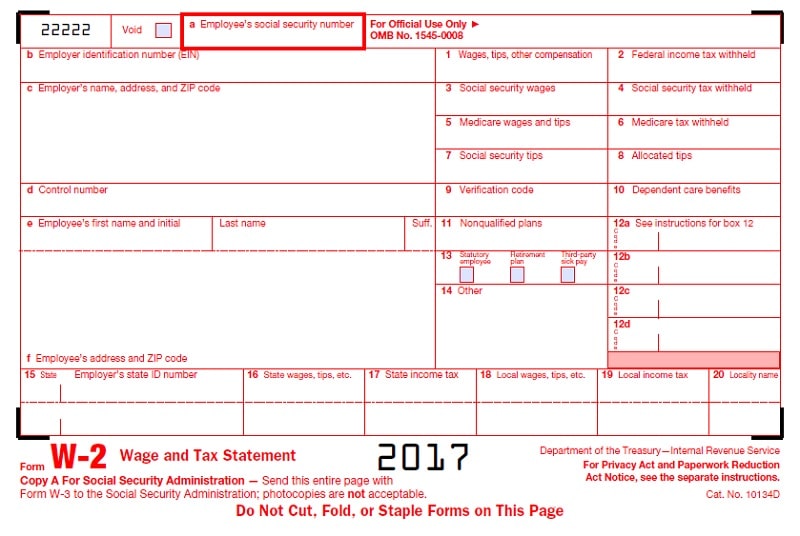

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. These boxes on the W-2 provide all the identifying information related to you and your employer. Many Employers Have W2 Lookup Online.

Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. ESmart Payroll has been providing IRS authorized payroll e-file since 2000. Explanation of Your W2.

It is also important to put these pay conversions in the larger context of your business structure and employment practices. Fast easy accurate payroll and tax so you save time and money. Payroll Employee Services is dedicated to serving the diverse university community by providing precise and timely remuneration to all staff faculty.

Calculate your total tax due using the tax calculator updated to. The company uses a W-2 tax form to report compensation annually and payroll taxes that are withheld from their employees pay. The forms are accessible for download and tax filing.

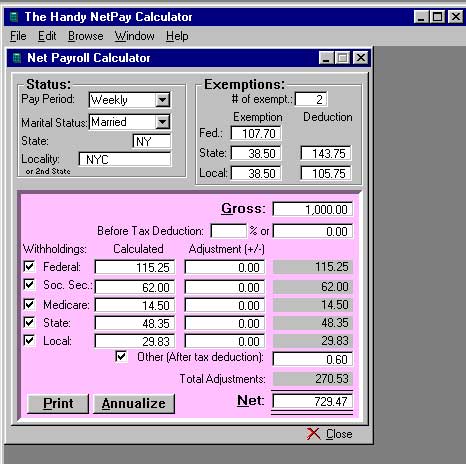

Such as Form W2 W3 940 941 1099. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Payroll Tax Calculator TimeTrex uses an advanced payroll calculation engine that will automatically calculate federal state and local income taxes as well as other custom deductions such as benefits insurance garnishments and vacation sick leave accruals.

You may also contact the Central Payroll Bureau in Annapolis at 410-260-7964. 2020 W-4 IRS Withholding Calculator. Use free or paid Paycheck Calculator app and precise Payroll Guru app to calculate employees payroll check in the residence state.

Easy to use quick way to create your paycheck stubs. For HR and Payroll Professionals. Use QuickBooks free payroll tax map to learn the payroll tax laws by state and important tax information when hiring your first employee.

Salary Calculator Contact Us FAQs. Use our free check stub maker with calculator to generate pay stubs online instantly. Lowest price automated accurate tax calculations.

You can print PDF copies after submission or ask us to print and mail forms W-2 W-2c and 1099-misc. Stryeyz and douglashuang9t are correct. The list of Advanced Payroll Memos for Comptroller of Maryland.

Call Payroll at 864-656-4884. A Form W2 and Form W4 are very different although many individuals and companies use and mess them up interchangeably. We consistently update our features to incorporate government relief programs and changes.

Harvards Central Payroll processes wage payments to all employees at the University issuing over 30000 W-2 forms per year. This kind of paper pairs perfectly fine with financial institutions as it is printed on a specific kind of paper that meets security specifications and conditions. In addition your company will usually let you know they have made an online-based W2 lookup open to you.

Read on to explore the differences and benefits of 1099 vs W-2 regarding both the forms and workers as well as other considerations to know before hiring a position for your business. NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny babysitter housekeeper personal assistant or any household employee. Compare the year-end pay stub information to the W2 statement.

Try paystub maker and get first pay stub for free easily in 1-2-3 steps. IRS Notice 2012-9 Q A-14 indicates that the amount reported with code DD is that aggregate cost of employer sponsored health insurance and is to include both the portion of the cost paid by the employer and the portion of the cost paid by the employee. 1099 vs W-2 forms.

Calculate net paycheck federal taxes payroll withholdings including SDI and SUI payroll state taxes with ease and on the. Paycheck Calculator PDF Non-overnight Meals Reimbursement Form. Non-owner W2 wages.

A 1099 vs W2 pay difference calculator can be a great tool for employers and hiring managers. Call Payroll at 864-656-5580. Lost Check - Reissue Paycheck Form.

You can prepare form 941 W-2 1099-misc and others one at a time online or upload a data file to file by the thousands. Works well with an electronic payroll software Try it with our paystub generator today Business Checks. Payroll Journal Payroll Register Employees W2 and 109910981096 forms.

As part of the Total Rewards Operations Center team in Human Resources Payroll is available to process paychecks taxes and direct deposit forms and help with all other payroll processes. SE Tax Payroll Taxes on owners wages. Did you know that reporting inaccurate holdings on a W4 form is possibly one of the most common payroll errors out there.

Generate W2 and 1099 forms without the hassle. Many companies like these offer w2 lookup online. Although most working individuals receive these forms Independent contractors file in a separate manner.

Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details. Replacement Lost Check Policy. Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying.

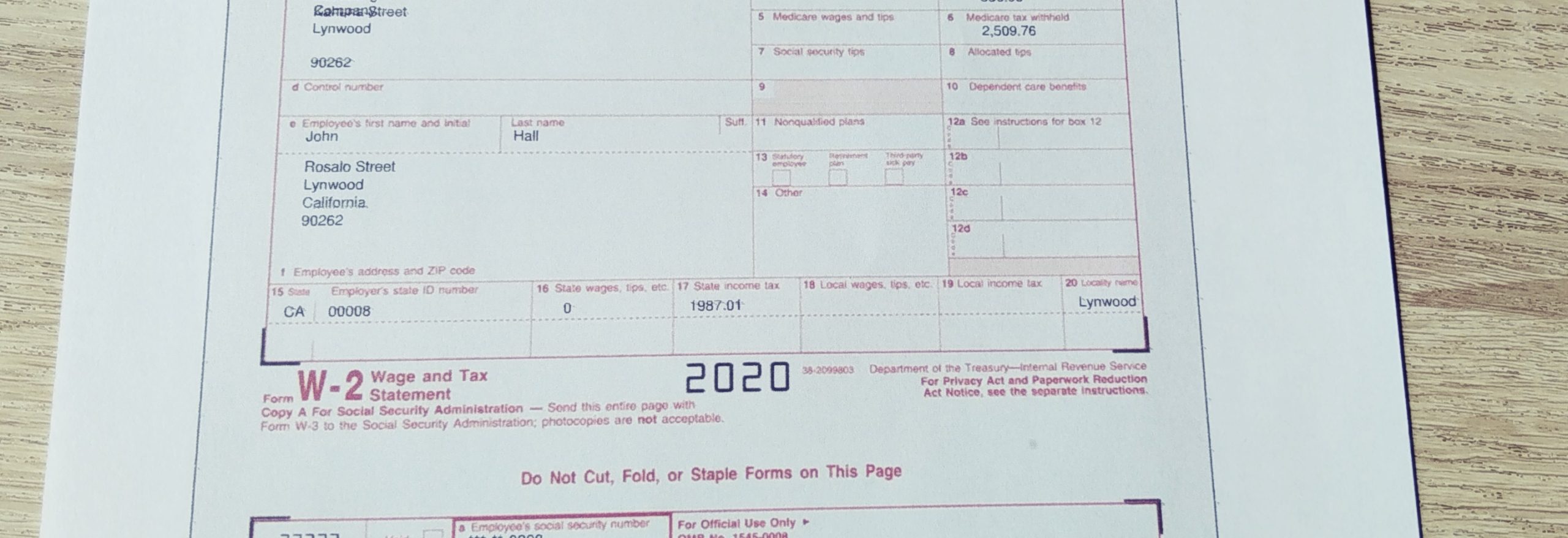

CU Online Special Pay Guide PDF. Banner Pay HolidayClosure Calendars W2 1095C Information Michigan Education Savings Program. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well.

If you still need help acquiring a replacement W2 contact the Financial Services help line at 410-704-5599 option 1 or finservehelp AT_TOWSON. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction. Canadian and international tax reports also.

W 2 1099 Filer Software Net Pr Calculator

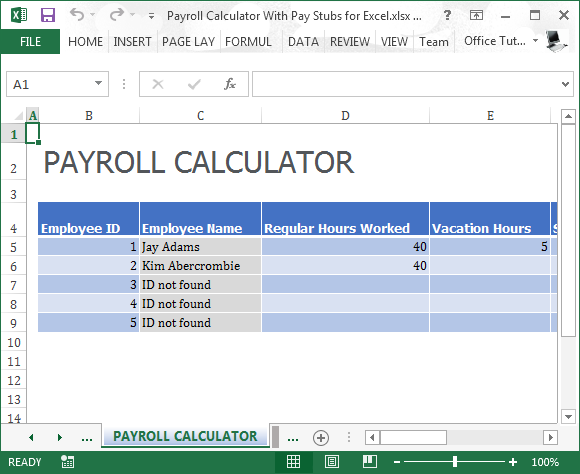

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Payroll Calculator Features Page

Solved W2 Box 1 Not Calculating Correctly

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate 2019 Federal Income Withhold Manually

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate W2 Wages From Paystub Paystub Direct

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To Calculate W2 Wages From Paystub Paystub Direct